e filing 2019 deadline

October 16 2019 703 PM The E-filing deadline for a self-prepared personal 1040 tax return is Oct 15 2019. 2019 returns must be filed by July 15.

E File Deadline Archives Rapidtax Blog

The government in a press conference dated May 13 2020 announced that the income tax return ITR filing deadline for all the entities for the financial year 2019-20 has been.

. In order to facilitate the e-filing of return the Income Tax Department has decided to give extension of 60 days for e-filing of return. ACA Penalties for Late Filing Small. Can I file electronically after April 15.

The IRS can also hold refund checks when the two subsequent annual returns are missing. IRS is not extending tax deadline. The Treasury Department and the Internal Revenue Service announced Monday it would stick with.

The filing deadline for tax year 2020 individual Federal 1040 tax returns is May17th. You must send your application to us before your normal filing deadline. The reason for this staggered approach to.

The timely tax deadline to pay and e-File 2021 Taxes is April 18 2022. November 7 2019 Winter is coming up quick. Federal tax returns filed by midnight May 17 2021 will be considered timely filed by the IRS.

If any payments for nonemployee compensation are reported in box 7 the due date is January 31 for. If you miss this date you have until. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara.

Non-provisional taxpayers who use SARS eFiling and the SARS MobiApp will have a longer period to file their returns with a deadline of 4 December. The filing deadline for tax year 2019 individual Federal 1040 tax returns is Wednesday April 15th. The Inland Revenue Authority of Singapore IRAS reminds all companies including those with no business activities or those in a loss position to e-File their Year of Assessment.

And there are more than a few year-end deadlines Finance must meet to guarantee IRS compliance and avoid pricey penalties. Previous Year Deadlines. Accordingly the last date for filing ITR for AY 2022.

October 15 or 17 2022 Due Dates. Previous tax year forms deadlines and calculators. If you e-file on Oct 15th and it is rejected by the IRS then you have until.

Federal tax debt you owe. You can apply for more time to file if something has happened that is out of your control and you. My electronic tax return keeps getting rejected because a dependents social security number SSN is used more than once on one return or.

That means you should file returns for. This topic provides electronic filing opening day information and information about relevant due dates for 1120 returns. The due date for filing Forms 1094-C and 1095-C with the IRS is February 28th 2023 if filing by paper and March 31st 2023 if filed electronically.

Federal tax returns filed by midnight Wednesday April 15 2020 will be. Taxpayers now have until December 31 to file their return of income earned between April 1 2019 and March 31 2020 instead of November 30. The below table outlines the.

IRS Form 1099-MISC filing deadline for 201920. For individuals required to get their. It can be used to pay.

IRS e-Filing Deadline March 31 2022 Tax Year 2021 IRS Filing Deadline e-File March 31 2022 Affordable Care Act forms 10941095B and 10941095C The links below are for Tax Year 2021. If April 15 falls on a weekend or legal holiday you have until midnight the next business day following April 15 to timely file either Form 4868 or your tax return. For filing deadlines and other information related to 1120 electronic.

Us Tax Deadline Extended To 17 May 2021 Nra Tax Tips

Tax Deadline Extension Now Includes Exempt Organizations Gyf

How To File An Extension For Taxes Form 4868 H R Block

Tax Extension Form 4868 Efile It Free By April 18 2022 Now

Tax Day 2019 No Time To File Here S What To Know About Getting An Extension Orange County Register

Rhode Island Division Of Taxation 2019

When Are Taxes Due Tax Deadlines For 2022 Bankrate

E Filing Last Date For Ay 2019 20 Tax Return Due Date Planmoneytax

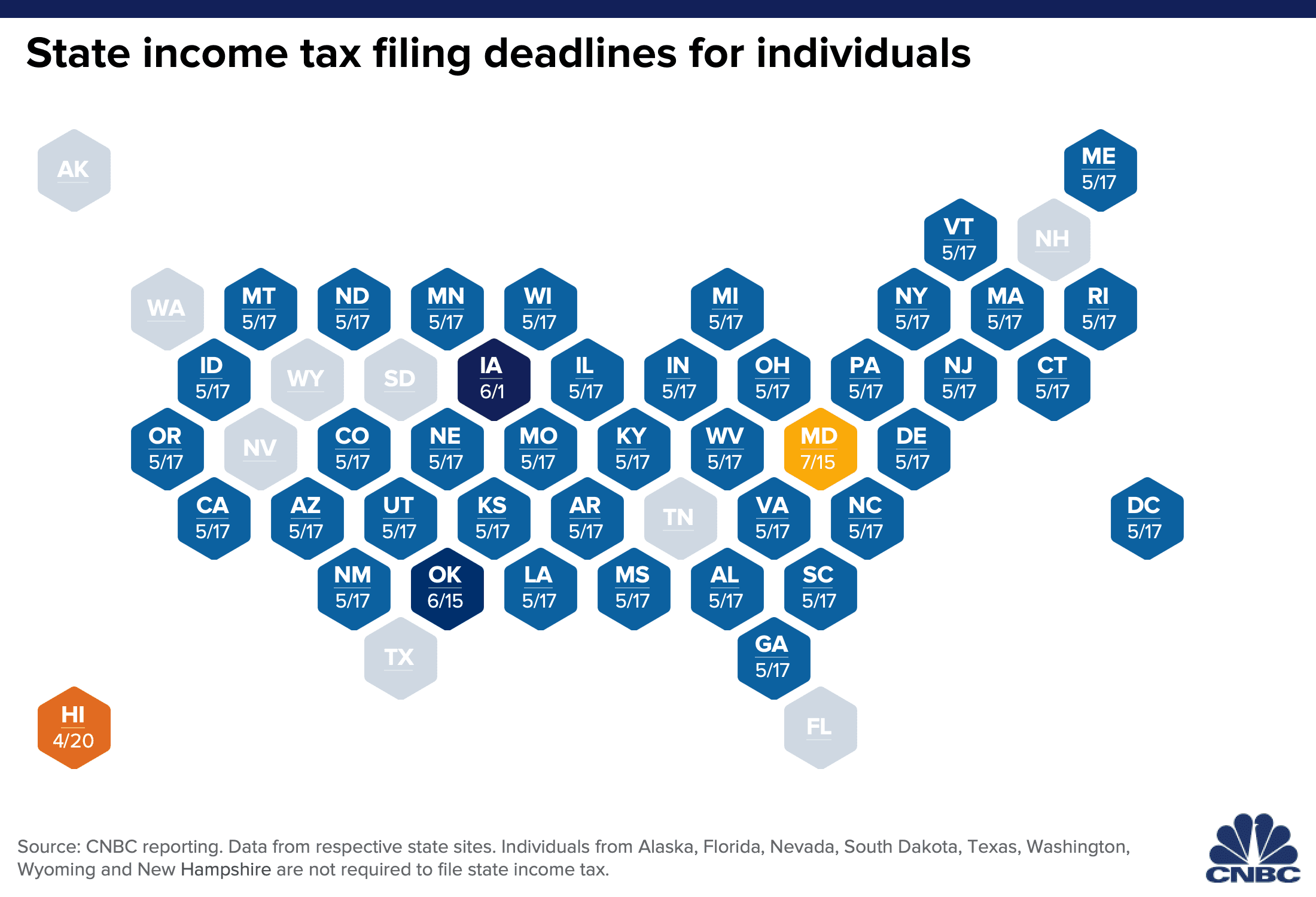

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Verify Deadline To File 2019 Taxes Changes Wusa9 Com

Irs E File Rejection Grace Period H R Block

Kaycee Miller Author At Rentec Direct Blog Page 23 Of 78

Cgcc E Connects New China Annual Tax Reconciliation Atr Filing Impact To Overseas Companies And Individuals China General Chamber Of Commerce Usa

Massachusetts Extends The Tax Filing Deadline

I Missed The Form 1099 Misc Deadline What Happens Next Blog Taxbandits

)

Income Tax Return Itr Filing Deadline How To File Penalty Charges Income Tax Slab Exemption Limit

Comments

Post a Comment